En 2022, el mercado nacional de tolueno, impulsado por la presión de los costos y la fuerte demanda interna y externa, registró un amplio aumento de precios, alcanzando su nivel más alto en casi una década, lo que impulsó aún más el rápido aumento de las exportaciones de tolueno, normalizándose. Durante ese año, el tolueno se convirtió en un producto con gran demanda en el mercado. Si bien el precio cayó en el segundo semestre, fue mayor que la tendencia de productos relacionados y las diferencias regionales. El inventario de tolueno muestra una tendencia acumulada, con poco impacto en el precio de mercado a corto plazo, a largo plazo podría limitar el aumento del precio y aumentar el riesgo operativo.

Resumen del mercado nacional de tolueno

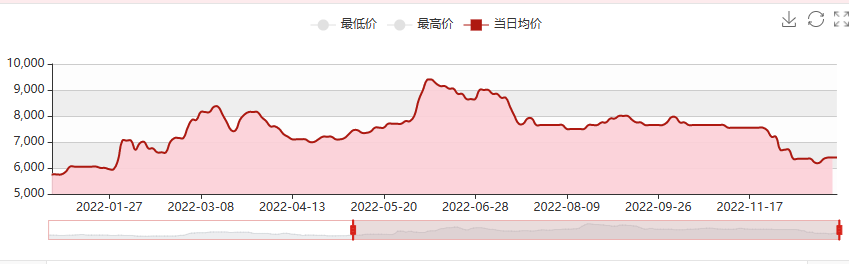

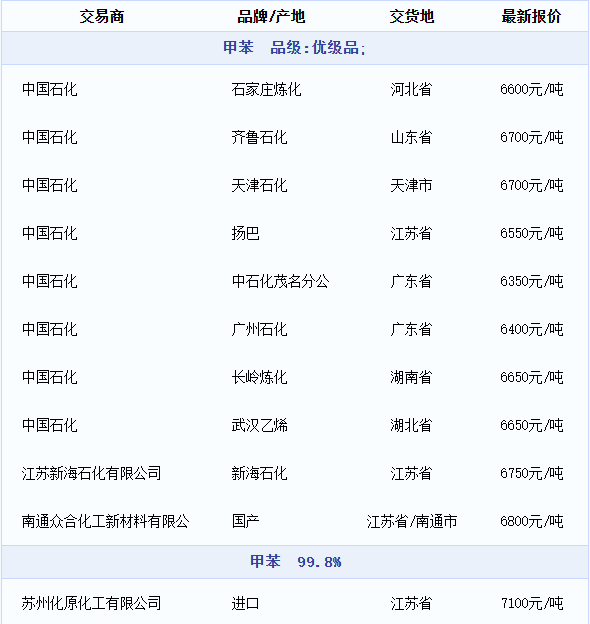

En 2022, el tolueno doméstico operará a un nivel alto, y el precio de transacción más alto del tolueno será de 9620 yuanes / tonelada, que es el precio más alto desde marzo de 2013. Al mismo tiempo, el precio del petróleo crudo aumentó en más del 50%, proporcionando un soporte efectivo al lado de los costos. El precio promedio anual fue de 7610.51 yuanes / tonelada, un aumento del 32.48% interanual; el punto más bajo del año fue de 5705 yuanes / tonelada en enero a principios de año, y el punto más alto fue de 9620 yuanes / tonelada a mediados de junio. En la actualidad, debido al lento crecimiento de la industria de la gasolina, la resistencia del mercado de materias primas para mantenerse al día con el crecimiento es relativamente grande, y solo hay unas pocas empresas. Muchas industrias downstream están cerradas por vacaciones, por lo que la atmósfera del tolueno es relativamente tranquila, y la tendencia de la industria de la gasolina es esperada. Hasta la fecha, la sucursal del norte de China de Sinopec Chemical Sales ha publicado el precio del tolueno en enero, con Tianjin Petrochemical y Qilu Petrochemical a 6500 yuanes/tonelada y la refinería de Shijiazhuang a 6400 yuanes/tonelada. La sucursal del este de China publicó el precio del tolueno en enero, con Shanghai Petrochemical, Jinling Petrochemical, Yangzi BASF y Zhenhai Refining & Chemical a 6550 yuanes/tonelada en el mercado al contado. El precio del tolueno en la sucursal del sur de China en enero fue de 6400 yuanes/tonelada para Guangzhou Petrochemical y de 6350 yuanes/tonelada para Maoming.

Petroquímica y Refinación y Química Zhongke.

Cotización del mercado del tolueno

Sur de China: La negociación del tolueno/xileno en el sur de China se ha estabilizado, y la leve fluctuación del precio intradía del petróleo ha dado soporte. Algunas empresas importantes han reportado bajos envíos de tolueno, y los comerciantes han compensado las ofertas. El volumen de negociación es positivo y las transacciones son justas. El xileno al contado es escaso, y las plantas terminales están descontinuando gradualmente su cotización, lo que ha reducido el volumen de negociación. El precio de cierre del tolueno es de 6250-6500 yuanes/tonelada, y el del xileno isomérico, de 6750-6950 yuanes/tonelada.

Este de China: La negociación del tolueno/xileno en el sur de China se ha estabilizado, y la leve fluctuación del precio intradía del petróleo ha dado soporte. Algunas empresas importantes han reportado bajos envíos de tolueno, y los comerciantes han negociado la reposición. El volumen de negociación es positivo y las transacciones justas. El xileno al contado es escaso, y las plantas terminales están descontinuando gradualmente su cotización, lo que ha reducido el volumen de negociación. El precio de cierre del tolueno es de 6250-6500 yuanes/tonelada, y el del xileno isomérico, de 6750-6950 yuanes/tonelada.

Análisis de la oferta y la demanda de tolueno

Lado de los costos: el petróleo crudo estadounidense cayó por dos días consecutivos al final de la semana, pero hubo soporte porque el inventario todavía estaba en un nivel bajo, por lo que era menos probable que cayera por debajo del nivel de soporte de US $ 70 / barril.

En cuanto a la oferta: En 2022, el inventario de tolueno en el puerto principal de Jiangsu mostró fluctuaciones constantes y repetidas, principalmente afectadas por las exportaciones periódicas del puerto. Sin embargo, en general, el inventario en el puerto principal de Jiangsu se mantuvo bajo durante el año posterior a agosto, pero a finales de año y principios del 23, el inventario en el puerto principal de Jiangsu aumentó a 60.000 toneladas, superior al promedio de 2022, y alcanzó un nivel relativamente alto en los últimos años. Tras el Año Nuevo, la presión de ventas de las empresas disminuyó, pero para garantizar una producción estable durante la Fiesta de la Primavera, se mantiene un ritmo de entrega estable.

Demanda: Con la llegada de la Fiesta de la Primavera, se prevé un aumento en el número de vehículos y viajes, lo que favorece la demanda de transferencia de combustible. El siguiente ciclo es el último para la preparación de mercancías en la fábrica de la terminal, y la terminal solo necesita apoyo. El precio del tolueno puede fluctuar en un contexto de oferta y demanda relativamente estables.

La posibilidad de fuertes turbulencias en el futuro mercado del tolueno es alta.

Se espera que el mercado nacional de tolueno se estabilice y fluctúe a corto plazo. 2023 será un año para intensificar el impulso. La situación económica en los países extranjeros no es optimista. Es difícil replicar la situación de un precio de mercado que aumenta rápidamente durante la temporada alta de viajes en Estados Unidos. Por lo tanto, no es probable que el precio del mercado nacional vuelva a subir al máximo de este año en 2023. Sin embargo, el problema del transporte ha mejorado gradualmente y se espera que la demanda nacional de transferencia de petróleo se recupere gradualmente en 2023. La demanda total ha aumentado gradualmente con la producción centralizada de la capacidad de producción aguas abajo. En general, se espera que el rango de fluctuación de precios del mercado nacional de tolueno se reduzca en 2023, y la posibilidad de fuertes shocks es alta.

Chemwines una empresa comercializadora de materias primas químicas en China, ubicada en la Nueva Área de Pudong de Shanghai, con una red de puertos, terminales, aeropuertos y transporte ferroviario, y con almacenes de productos químicos y químicos peligrosos en Shanghai, Guangzhou, Jiangyin, Dalian y Ningbo Zhoushan, China, almacenando más de 50,000 toneladas de materias primas químicas durante todo el año, con suministro suficiente, bienvenido a comprar y consultar. Correo electrónico de chemwin:service@skychemwin.comWhatsApp: 19117288062 Teléfono: +86 4008620777 +86 19117288062

Hora de publicación: 13 de enero de 2023